CaribbIN to beat BrEXIT

Read UPDATE here!

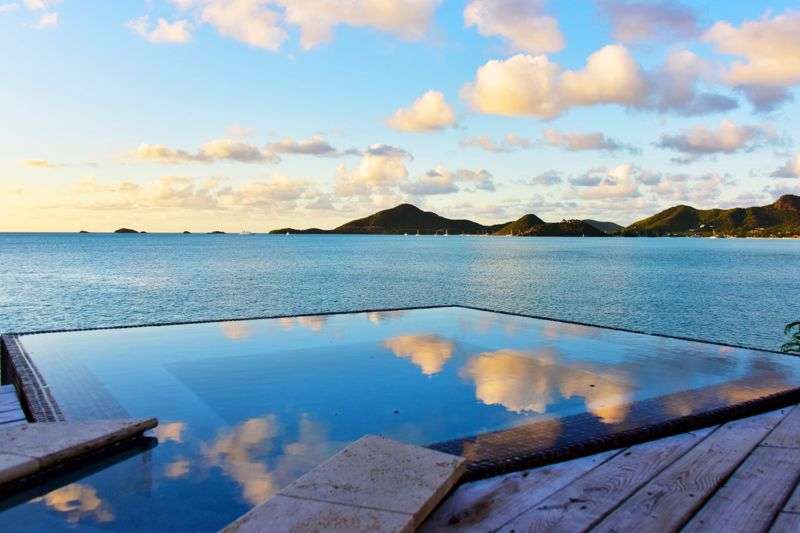

Sitting on a sunny terrace of the beachfront house in Barbados, I am reflecting on the news:

‘The Bank of England’s governor [Mark Carney] has warned the cabinet that a chaotic no-deal Brexit could crash house prices and send another financial shock through the economy. Mark Carney met senior ministers on Thursday to discuss the risks of a disorderly exit from the EU. His worst-case scenario was that house prices could fall as much as 35% over three years, a source told the BBC’ – 14 September 2018.

So what might you do to avoid the property pains of Brexit and why CaribbIN?

Strong Returns. Reference to the Global Property Guide, a website providing comprehensive information on buying overseas property, reveals that gross rental yields are high in many of the Caribbean countries. The rental “yield” is what an investor can expect as an annual return on his investment. Yield is the gross annual rental income expressed as a percentage of today’s property purchase price. Of course, being gross it is necessary to be very careful about the costs incurred to ensure that the net yield remains high. Based upon our experience, it is a straightforward process to ensure that costs, and therefor yields, are carefully managed.

It cannot be ignored that the Caribbean has a healthy tourism industry, with year round rental income potential for property owners. With a good number of tourists visiting each year, primarily from Europe, North and South America, those who choose to rent out their property whilst away can profit.

Access to investor-friendly flexible structures. Some of the Caribbean countries, like the British Virgin Islands (BVI) are well known for the structures they provide, that can be readily used to support a real estate investment. Furthermore, in some islands there is no property tax to pay when purchasing a property and USD mortgages are available to non-nationals from some banks.

Currency diversification. Investing in foreign real estate in the Caribbean provides earnings, the profit from the rental of the unit, in foreign currency. Many of the islands in the region have their currencies pegged to the dollar, which can be beneficial from a stability standpoint.

Limited space, high demand. With real estate, typically location is everything. In keeping with real estate investment everywhere, the limited availability of prime location real estate in the Caribbean ensures that demand remains high and resilient, so that an investment is safeguarded.

Potential to use local expertise to diversify your asset portfolio. From our own personal experience, we know that the Caribbean has a very strong core of professionals with expert real estate investment skills.

In effect, from a financial perspective, an investment in Caribbean real estate offers the opportunity to achieve and enjoy a very good return. But read on: From a personal perspective your Caribbean investment provides other important non-financial benefits such as:

Climate. With yearlong sunshine and average temperatures of 27 – 29 Celsius the weather is fantastic, and ideal for either an active lifestyle or a more relaxed experience. Many islands also have white sandy beaches, turquoise sea, and picturesque landscapes making them the perfect tranquil setting to escape the hustle and bustle of modern life.

Ease of access. Many islands have international airports that are world class, with regular daily direct flights to and from Europe and North America. A flight from North America is relatively short, and it takes around 8 hours to travel from Europe.

Reputation. Many of the islands are renowned for their stability, good educational standards, relatively low crime rate and quality of life. This makes them a very attractive prospect as a location for a second home, or even to live, work and raise a family.

Good infrastructure. Many islands have a robust infrastructure, with good roads and utilities. The telecommunications infrastructure in a number of islands feature the latest digital and fibre optic technology systems, providing reliable telephone and internet services.

Healthcare. The quality of healthcare in Barbados, and in many islands, is very good. For example, Barbados boasts modern facilities and has been ranked among the best in the Caribbean. There the government runs the Queen Elizabeth Hospital with 600 beds, and provides a 24-hour casualty department, as well as specialist services.

Social scene and amenities. There are many great bars, clubs and restaurants on the islands, and there are generally plenty of festive or cultural events taking place throughout the year. Depending upon the specific island location, there are also plenty of things to do from sailing, shopping, visiting museums, to horse racing or polo.

Good, you might be thinking, but on the same BBC news there were hurricane and tropical storm warnings. Many beautiful residential properties worldwide suffer natural disasters – Florida with hurricanes, Italy and Turkey with earthquakes – and the Caribbean is no exception. Hurricanes are an annual problem that can potentially destroy an investment. However, hurricane insurance is available at relatively inexpensive prices to protect your investment, although sadly not the effect on lost rental income. But do take note, not all islands suffer these disasters equally, and there are some havens that are rarely affected, for example:

Aruba, Bonaire, Curacao – hurricane frequency, every 28.8 years

Dominican Republic – hurricane frequency, every 11.08 years

Barbados – hurricane frequency, every 20.57 years

For sure Aruba, Bonaire and Curacao have beachfront homes for sale, but they are the preferred choice of native Dutch language speakers for whom the culture and environment are more familiar. Similarly, the Dominican Republic has beautiful villas in some locations, but it is very heavily influenced by its Spanish roots and less inviting to those who like British traditions.

From my perspective CaribbIN means BarbadIN, Little England!

One more piece of news, this year has been the best for interest in properties in Barbados for a long time, and mainly from UK investors. Wise investors are not fools. The effect of Brexit, the prospects for a profitable return on investment and the relative security from natural disasters have doubtless been key motivators.

Read UPDATE here!